Life Insurance in End-of-Life Planning – Securing Family Futures

- Lincoln De Freitas

- Dec 24, 2025

- 8 min read

Nearly half of Canadian adults over age fifty worry about how their families will manage rising end-of-life expenses. Health challenges can make affordable life insurance feel out of reach, especially as Canadian and American costs for funerals continue to climb. Understanding the key roles of life insurance in end-of-life planning can help you protect loved ones from sudden financial stress and leave a meaningful legacy, even if you face medical concerns.

Table of Contents

Key Takeaways

Point | Details |

Life Insurance as a Financial Tool | Life insurance provides critical financial protection for families by covering income loss, debts, final expenses, and supporting legacy planning. |

Types of Life Insurance | Understanding the different types of life insurance, such as whole, term, and final expense insurance, is essential for choosing the right coverage based on individual needs. |

Financial Impact of Payouts | Insurance payouts help families manage end-of-life costs like funeral expenses and medical bills, alleviating financial strain during difficult times. |

Regular Policy Review | Conducting periodic assessments of life insurance policies ensures coverage aligns with evolving family needs and financial situations. |

Role of Life Insurance in End-of-Life Planning

Life insurance represents a critical financial strategy for protecting families during challenging transitions, serving as a powerful mechanism for securing financial futures beyond an individual’s lifetime. When thoughtfully selected, these financial instruments provide more than simple monetary compensation they create a comprehensive safety net for loved ones facing potential economic uncertainty.

At its core, life insurance functions as a strategic financial tool designed to replace income for dependents and cover final expenses. The insurance helps families navigate complex financial landscapes during emotionally challenging periods, ensuring that critical expenses like funeral costs, outstanding debts, and ongoing living expenses can be managed without causing additional stress. By transferring financial risk from the family to the insurance provider, individuals can create a structured plan that provides meaningful protection.

The primary roles of life insurance in end-of-life planning encompass several critical dimensions. These include:

Income Replacement: Providing financial support for dependents who rely on the primary earner’s income

Debt Settlement: Covering outstanding financial obligations to prevent economic burden on surviving family members

Funeral Expense Coverage: Ensuring immediate funds are available for final arrangements without creating financial strain

Legacy Planning: Creating an inheritance or financial foundation for future generations

Pro Tip: Strategic Planning: Conduct a comprehensive financial review every two to three years to ensure your life insurance coverage continues to match your family’s evolving financial needs and circumstances.

By understanding life insurance as more than a simple financial product but as a holistic family protection strategy, individuals can make informed decisions that provide genuine peace of mind during life’s most challenging transitions.

Types of Life Insurance for Final Expenses

Navigating the landscape of life insurance requires understanding the diverse options available for covering final expenses, each designed to address unique financial needs and personal circumstances. Individuals approaching retirement or managing complex health considerations must carefully evaluate these different policy types to ensure comprehensive protection for their loved ones.

One fundamental option is final expense insurance, which is specifically designed to cover end-of-life costs such as funeral and burial expenses. These smaller policies are typically easier to qualify for and particularly attractive to older adults who want to prevent financial burdens on their families during an already challenging time. Unlike traditional life insurance policies with extensive medical underwriting, final expense insurance offers more accessible coverage.

The primary types of life insurance for final expenses include:

Whole Life Insurance

Provides permanent coverage

Builds cash value over time

Guaranteed death benefit

Term Life Insurance

More affordable short-term coverage

Specific duration protection

Lower initial premiums

Guaranteed Issue Life Insurance

No medical examination required

Accepts most applicants

Higher premiums due to increased risk

Final Expense Whole Life Insurance

Specifically targeted for funeral and burial costs

Smaller face value policies

Simplified underwriting process

Pro Tip: Policy Matching: Conduct a thorough assessment of your financial obligations and health status to select a life insurance policy that precisely matches your end-of-life expense needs and budget constraints.

Here’s a comparison of common life insurance types used in end-of-life planning:

Policy Type | Duration | Cash Value | Typical Use Case |

Whole Life Insurance | Lifetime coverage | Builds over time | Long-term family security |

Term Life Insurance | 10–30 years | None | Temporary or budget protection |

Guaranteed Issue Insurance | Lifetime coverage | None | Difficult health or age cases |

Final Expense Insurance | Lifetime coverage | Minimal | Covering funeral and burial costs |

How Payouts Support End-of-Life Costs

Life insurance payouts represent a critical financial safety net that provides comprehensive support during one of life’s most challenging transitions. These financial resources extend far beyond simple monetary compensation, offering families a structured approach to managing complex financial responsibilities that emerge after a loved one’s passing.

Insurance payouts are strategically designed to cover a wide range of end-of-life expenses, including funeral costs, probate fees, medical bills, and outstanding financial obligations. The flexibility of these funds allows families to address immediate financial pressures without depleting personal savings or creating additional emotional strain during a period of grief. By providing a timely and comprehensive financial buffer, life insurance payouts help prevent economic hardship and allow families to focus on emotional healing.

The typical financial support provided through life insurance payouts can be categorized into several key areas:

Funeral and Burial Expenses

Covering direct funeral service costs

Purchasing cemetery plots

Paying for memorial services and cremation

Medical and Healthcare Expenses

Settling outstanding medical bills

Covering final hospitalization costs

Addressing potential long-term care expenses

Legal and Administrative Costs

Probate and estate settlement fees

Legal document processing

Tax preparation and filing

Debt Resolution

Paying off remaining personal loans

Settling credit card balances

Addressing mortgage or vehicle financing

Pro Tip: Financial Documentation: Maintain a comprehensive file of all financial documents, insurance policies, and beneficiary information to streamline the payout process and reduce potential administrative complications during an already challenging time.

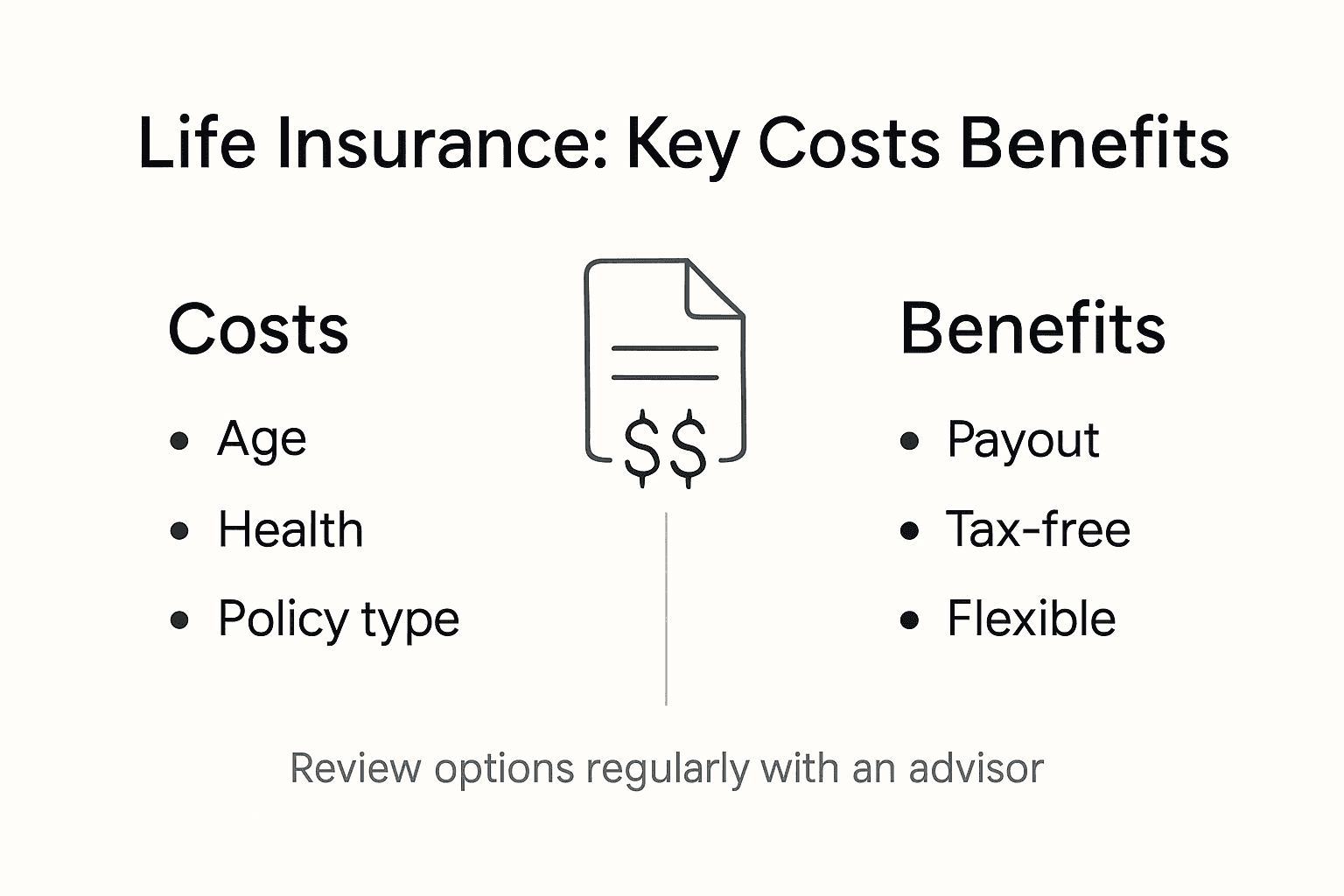

Costs, Premiums, and Tax Implications

Life insurance represents a complex financial investment that requires careful consideration of multiple interconnected factors, including ongoing costs, premium structures, and potential tax implications. Understanding these financial dimensions helps individuals make informed decisions that align with their long-term financial planning goals and family protection strategies.

Premium costs vary significantly based on multiple factors, including age, health status, coverage amount, and policy type. Younger, healthier individuals typically qualify for lower premiums, while older adults or those with pre-existing health conditions may face higher rates. Life insurance offers unique tax advantages, including tax-deferred growth of cash values and tax-free death benefits for beneficiaries, making it an attractive financial planning tool beyond simple risk mitigation.

Key financial considerations for life insurance policies include:

Premium Calculation Factors

Age at policy initiation

Current health status

Lifestyle and risk factors

Desired coverage amount

Policy type selected

Cost Structure Variations

Fixed premium policies

Adjustable premium plans

Term-based pricing models

Whole life insurance rates

Tax Implications

Tax-free death benefits

Tax-deferred cash value growth

Potential tax-efficient loans

Estate tax planning opportunities

Additional Financial Considerations

Potential cash value accumulation

Withdrawal and loan options

Surrender value calculations

Long-term financial planning integration

Pro Tip: Financial Optimization: Consult with a tax professional and financial advisor to understand the specific tax implications and optimal premium strategy for your unique financial situation and long-term planning goals.

This summary highlights key factors that impact life insurance costs and tax benefits:

Cost Factor | Effect on Premium | Tax Benefit Insight |

Age | Younger = lower premium | Death benefit tax-free to heirs |

Health Status | Better health = lower cost | Cash value growth is tax-deferred |

Policy Type | Permanent = higher cost | Policy loans may be tax-advantaged |

Coverage Amount | Higher coverage = higher cost | Death benefit may aid estate taxes |

Payment Structure | Fixed or adjustable prices | Withdrawals can have tax effects |

Choosing the Right Policy for Your Family

Selecting the appropriate life insurance policy represents a critical decision that requires careful analysis of your family’s unique financial landscape and long-term protection needs. The complexity of this choice demands a comprehensive understanding of various policy types, personal financial circumstances, and potential future scenarios.

Choosing the right life insurance policy involves systematically assessing individual needs and understanding the nuanced options available, including term, whole, universal, and variable life insurance. Each policy type offers distinct advantages and limitations, making it essential to align the selected coverage with specific family financial goals, current income levels, and anticipated future expenses.

Key considerations when selecting a life insurance policy include:

Financial Needs Assessment

Current family income

Outstanding debt levels

Anticipated future expenses

Children’s educational requirements

Retirement planning goals

Policy Type Comparison

Term Life Insurance

Lower initial premiums

Specific coverage duration

Ideal for short-term protection needs

Whole Life Insurance

Permanent coverage

Cash value accumulation

Guaranteed death benefit

Universal Life Insurance

Flexible premium payments

Adjustable death benefits

Investment component

Variable Life Insurance

Investment-linked policies

Potential higher returns

Greater financial risk

Risk Tolerance Evaluation

Personal financial stability

Investment experience

Comfort with financial uncertainty

Long-term financial objectives

Pro Tip: Comprehensive Review: Schedule an annual policy review with a financial advisor to ensure your life insurance coverage continues to match your evolving family dynamics and financial landscape.

Secure Your Family’s Future with Trusted Life Insurance Solutions

Facing end-of-life planning can be overwhelming, especially when trying to ensure your loved ones are protected from unexpected financial burdens like funeral costs, medical bills, and outstanding debts. The article highlights the importance of life insurance as more than just a policy. It is a vital tool that provides peace of mind by covering final expenses and replacing income for your family at a difficult time. Choosing the right policy, whether it be guaranteed issue life insurance or whole life coverage, is essential to align with your unique needs and budget.

Do not leave your family unprotected during life’s most challenging moments. At LD Financial Services, we specialize in compassionate, clear, and affordable final expense insurance. Our expert agents help you navigate simplified application processes, quick approval, and fixed premiums designed specifically for middle-aged and senior adults planning their financial legacy. Learn more about how you can protect your family by visiting our homepage or explore detailed options like guaranteed issue life insurance tailored for individuals with health concerns.

Take action today to secure a financial safety net that truly supports your loved ones when they need it most.

Don’t wait until tomorrow. Book your appointment with a licensed agent at LD Financial Services now and start your journey toward peace of mind and family protection.

Frequently Asked Questions

What is the role of life insurance in end-of-life planning?

Life insurance plays a crucial role in end-of-life planning by providing financial support for dependents, covering final expenses such as funeral costs, settling debts, and creating a legacy for future generations.

What types of life insurance are available for covering final expenses?

Types of life insurance for final expenses include whole life insurance, term life insurance, guaranteed issue life insurance, and final expense whole life insurance, each designed to meet different financial needs and circumstances.

How do life insurance payouts help with end-of-life costs?

Life insurance payouts help cover a variety of end-of-life costs, including funeral and burial expenses, medical bills, legal fees, and settling outstanding debts, allowing families to manage financial responsibilities during a challenging time.

What factors affect the cost of life insurance premiums?

The cost of life insurance premiums is influenced by multiple factors, including the policyholder’s age, health status, chosen coverage amount, policy type, and overall lifestyle risk factors.

Recommended

.png)

Comments